What the Upcoming IPOs tell us about the State of the Fashion Industry

While the IPO activity has been slow in the first quarter of the year, we have a few brands on our radar which we hear are going to IPO in the year. So what do these brands tell us about what we are consuming and whats going mainstream today?

VUORI

Key takeaways for the industry

Slow & steady, is the only way to scale a D2C brand, with a sharp focus on product

Activewear continues to be a popular apparel category post-pandemic as fashion took a more casual turn. (for eg. Lululemon Athletica Inc. stocks also grew 20 percent this year on strong demand and expanding margin)

Vuori’s founder, Joe Kudla, launched the brand in 2015 and struggled to find VC funding for several years.

Starting the brand off with USD 700K all raised within friends family, Kudla’s key strategy was to make unit economics profitable. While a lot of D2C brands were focussed on customer acquisition at any costs, Kudla, who was accountant by profession, was focussed on making profits on every acquisition.

Kudla’s slow and profitable growth caught the eye of investors. In 2021, Japanese investor Softbank poured $400 million into Vuori, landing it a whopping $4 billion valuation. Now, Vuori is headed towards an IPO, which could come as soon as mid-2024.

Vuori’s Business Model & Expansion |

“I was singularly focused on product, whereas many other DTC startups of this era were focused on innovative new distribution strategies,” says Kudla. For Vuori to be successful, Kudla felt it was important to focus on using high quality fabrics that would look comfortable against the skin, with designs that were sleek and minimalist. While direct-to-consumer brands sold exclusively through their own websites and stores, because it would allow them to keep more of the revenue, Kudla was happy to sell through department stores and retailers, even though that meant giving them a third to half of the revenue, because they had established distribution networks and could expose the brand to new audiences. Vuori started selling at REI, Nordstrom, Selfridges, Harrods, and Equinox gyms.

This strategy was successful and by year two, Vuori was generating $1 million in revenue, and was profitable.

By 2018, Vuori was generating upwards of $30 million in revenue, and launched women’s clothing. Today, it has since established an international presence with locations in countries including the UK and China.

II. Shein:

Key Takeways for the industry

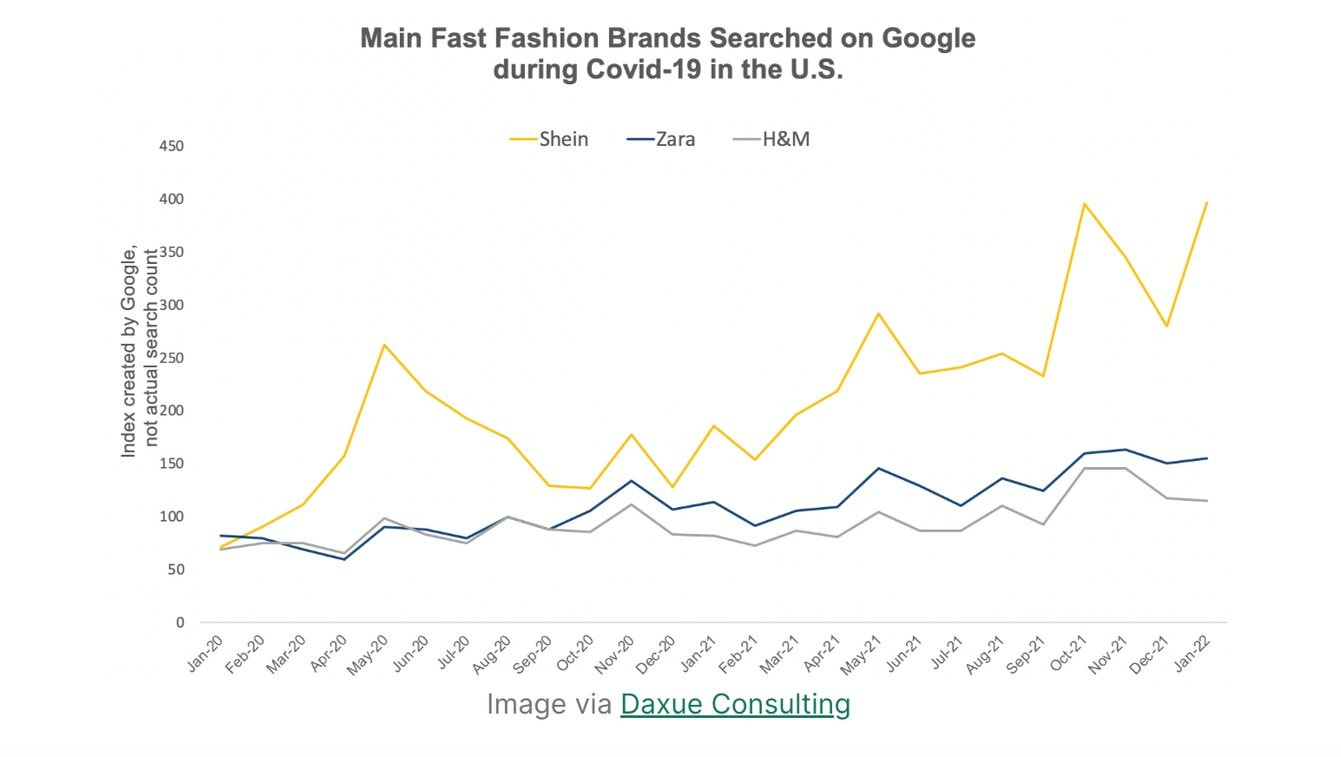

Globally, there’s nothing stopping ultra fast-fashion. Despite strong regulations on the fashion industry being implemented in the EU, in most parts of the world, people want their fashion fast, with ease and customised to their searches.

Customer habits are drifting towards one-stop-shop purchasing experiences like SHEIN. As of 2022, 66% of consumers preferred online marketplaces over traditional retailer sites, and B2C marketplaces are projected to facilitate $2.1 trillion in sales by 2024. (Mirakl)

We care about sustainability, just not enough to put our money where the mouth is, unfortunately.

Customer discovery is still heavily reliant on social platforms like TikTok and Instagram, with 67% of consumers in 2023 having bought products through social media.

The fast-fashion industry is safe ‘n sound. And rich!

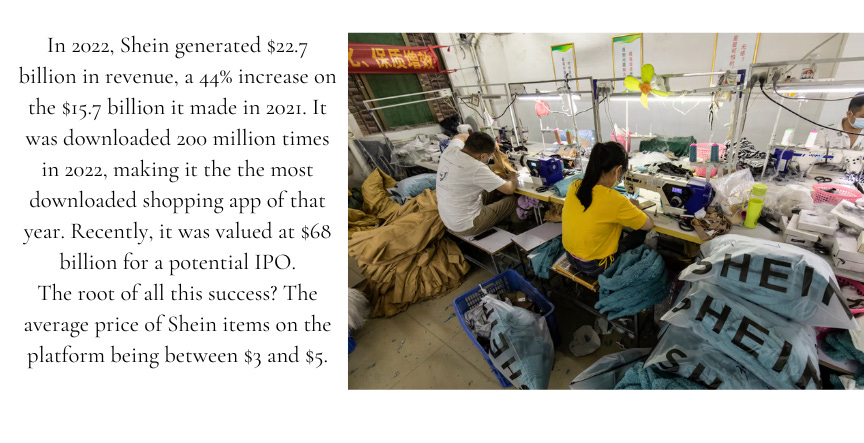

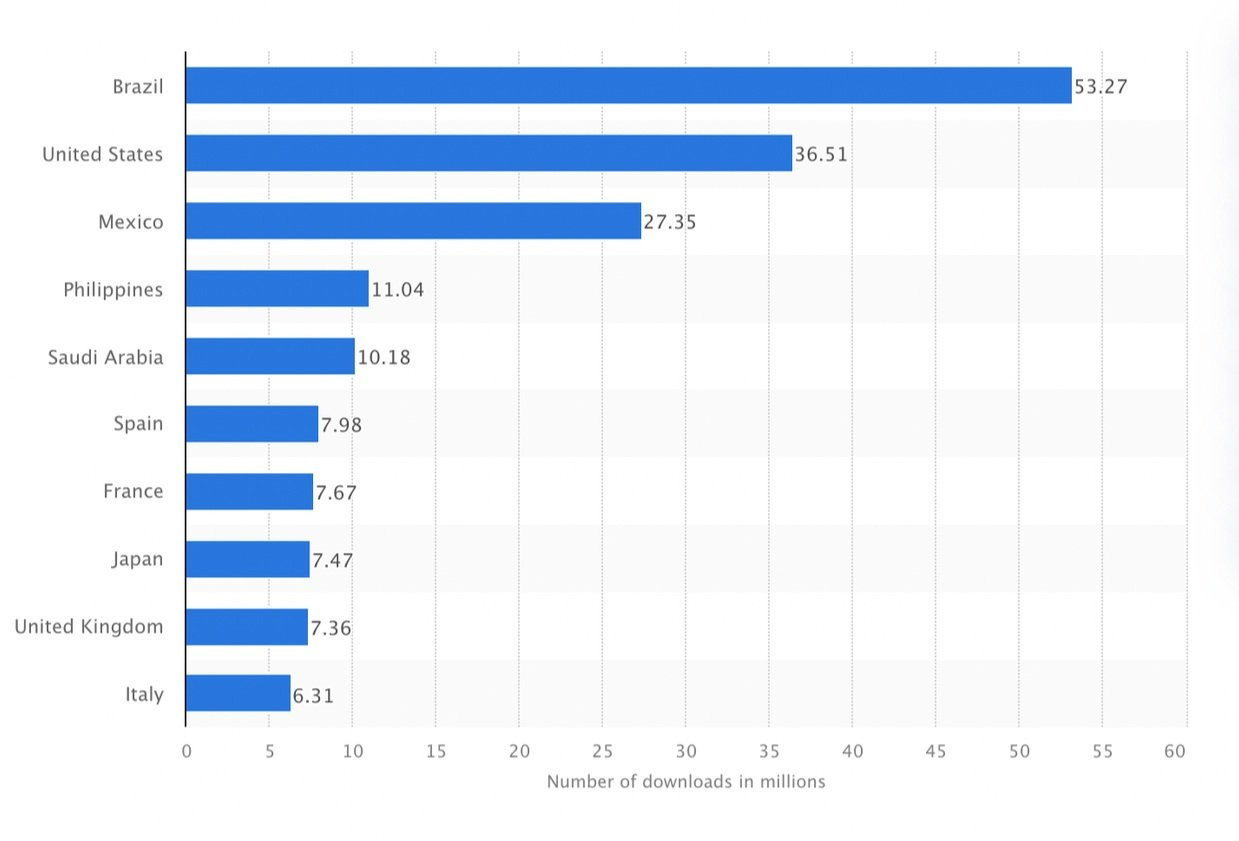

In 2022, Shein generated $22.7 billion in revenue, a 44% increase on the $15.7 billion it made in 2021. It was downloaded 200 million times in 2022, making it the the most downloaded shopping app of that year. Recently, it was valued at $68 billion for a potential IPO.

The root of all this success? The average price of Shein items on the platform being between $3 and $5. So how does Shein make this happen and what does it mean for the fashion industry?

Shein’s Business Model & Expansion |

On-demand inventory management | Predicated on H&M and Inditex’s “test and repeat” model, just 6% of Shein’s inventory remains in stock for more than 90 days. It relies on third-party suppliers in China to produce small batches of clothes, about 50-100 per item. If an item does well, more batches are commissioned; if not, the lines are immediately discontinued. The internal inventory management software analyzes consumer behavior in real-time, allowing Shein to “algorithmically” feed products to users, adding up to 10K individual items and styles to its platform every day.

Cheap Labour & materials | Shein has heavily relied on cheap materials such as nylon and polyester and cheap labour in China to build its billion-dollar empire. Channel 4’s exposé on Shein factory workers revealed that they were making a base salary of 4,000 yuan per month, about $556, while having to produce 500 articles of clothing a day, according to the report.

In Guangzhou, the city where Shein is headquartered and where many of its suppliers are located, researchers were able to track down 17 Shein partners. They found some manufacturers were informal factories set up in residential buildings. Some also had barred windows and no emergency exits, according to Public Eye; conditions that violate Chinese labour laws. Workers in Guangzhou also told the researchers they sewed for 12 hours a day, working about 75 hours a week, and only received one day off a month.

At Shein’s packing facility in the city of Foshan, workers also said they worked 12 to 14-hour days and up to 28 days a month. Chinese labour laws state workweeks cannot exceed 40 hours, and overtime cannot exceed 36 hours per month. Workers must also receive one day off per week.

These horrific revelations have led Shein into significant trouble regarding its IPO in the US. Shein has been subject to scrutiny from the US, with officials asking the SEC to block its listing, unless it agrees to disclose more about its operations in China. US-China trade tensions have also been simmering for years and at the moment Shein is taking its IPO to the London Stock Exchange.

Skimming out on custom charges | Shein keeps its prices low through a U.S. shipping provision called the “de minimis exception,” which waives duty fees for any packages with a retail value of less than $800. Shein packages rarely reach the de minimis maximum – the average Shein shopper spends $100 per month. According to the June congressional report, Shein paid no duty fees on imports to the U.S. in 2022. In comparison, H&M paid $205 million.

III. Skims

Key takeaways for the industry

While celebrity- led brands always have a leg up, what keeps them going is great product + great marketing.

“Shapewear as Sexy” is a new category primarily developed by Skims with several new knock-offs gaining popularity on social media.

Catering to diversity is good for business. Body diversity, colour diversity, age diversity are all important value propositions today and brands that can deliver it well have a significant edge.

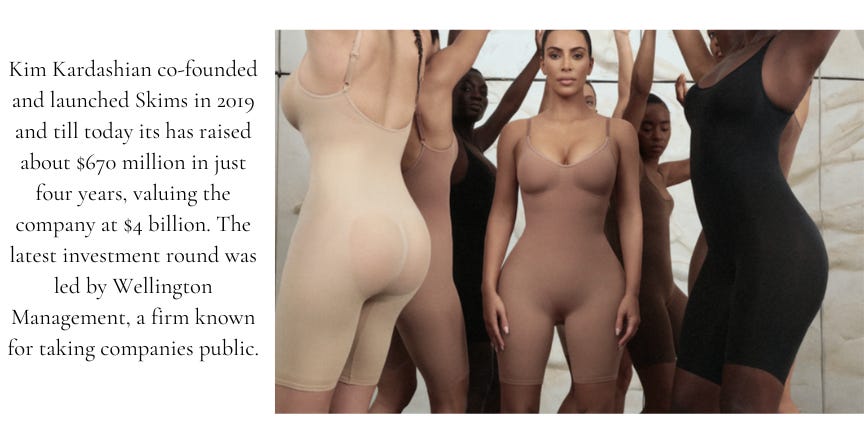

Kim Kardashian launched Skims, the clothing line she co-founded in 2019 and till today its has raised about $670 million in just four years, valuing the company at $4 billion. The latest investment round was led by Wellington Management, a firm known for taking companies public. The company started as a seller of shapewear to help customers fit into body-hugging clothing. But shapewear no longer represents a majority of its sales: Skims has expanded into an array of clothing categories, including loungewear and swimwear, with plans to branch out into men’s clothing.

Skims’s Business Model & Expansion |

Product drops as a new religion | While Skims treated their Product launch like a religion by creating ultra-hype through sensual imagery and influencer marketing, it also helped that some of their products are unique (read: bizzarre) enough to start an online debate, in effect leading to more traction. Cue in: the Nipple Bra.

Ranging from ardent lovers who deem this product as liberating to women who consider it to be form of body-objectification, it has definitely been able to stir a whirlwind of conversation online that has further augmented the already wide reach of Skims.

2. Stellar Collaborations | Skims has collaborated with several athletes like, Neymar Jr, Shai Gilgeous-Alexander, Patrick Maholmes, and celebrities like Lana Del Rey, and Usher. All these different collaborations target Skim’s demographic and help generate buzz and drive sales. They also collaborated with luxury fashion house Fendi to launch a capsule collection under the Skims brand. The collection featured Skims products adorned with Fendi’s iconic logo print. As well as a collaboration with the Los Angeles-based fashion brand Naked Wardrobe for a loungewear collection released in December 2020. These collaborations have helped them maximize their reach manifold.

Further reading:

https://medium.com/divine-magazine-detroit/fashion-brand-ipos-worth-your-investment-da1a5cdade86

https://www.fastcompany.com/90993776/shein-ipo-what-it-could-mean-for-the-fashion-industry

https://www.fastcompany.com/90981570/how-vuori-defied-the-dtc-apocalypse-to-become-a-4-billion-athleisure-juggernaut

https://futurestartup.com/2023/11/06/a-brief-history-of-shein/

https://www.nytimes.com/2023/07/19/business/dealbook/skims-kim-kardashian-fundraise.html?campaign_id=4&emc=edit_dk_20230719&instance_id=97894&nl=dealbook

https://www.indigo9digital.com/blog/skimsstrategy